Media Contact:

Vincent Plymell

vincent.plymell@state.co.us

Division reviewed claims data from 61 insurance companies.

DENVER - One of the more troubling issues in the aftermath of the Marshall Fire has been the problem of underinsurance for people who lost their homes. Underinsurance is when the amount of money a homeowner will receive from their insurance company is not enough to repair or replace the home.

To understand the scope of the underinsurance problem, the Colorado Division of Insurance (DOI), part of the Department of Regulatory Agencies (DORA), has collected claims data from the insurance companies with claims from the Marshall Fire and Straight Line Winds disaster. Each month the insurance companies must continue to report this data to the DOI, so it is expected that the data will become further refined with future submissions.

“Before diving into solutions that tackle underinsurance, we needed to determine the potential size and scope of the problem,” said Colorado Insurance Commissioner Michael Conway. “This is our initial analysis, but we will continue to analyze the claims data as it comes in from the insurance companies. However the challenge now and going forward will be nailing down reliable rebuilding costs."

Determining the Number of Total Losses

Twenty seven insurance groups representing 61 homeowners’ insurance companies (for example the Allstate group represents six individual companies, and Liberty Mutual represents five companies) provided claims data from the Marshall Fire. The 61 homeowners’ insurance companies represent 97% of the market share of all companies selling homeowners’ insurance in Colorado.

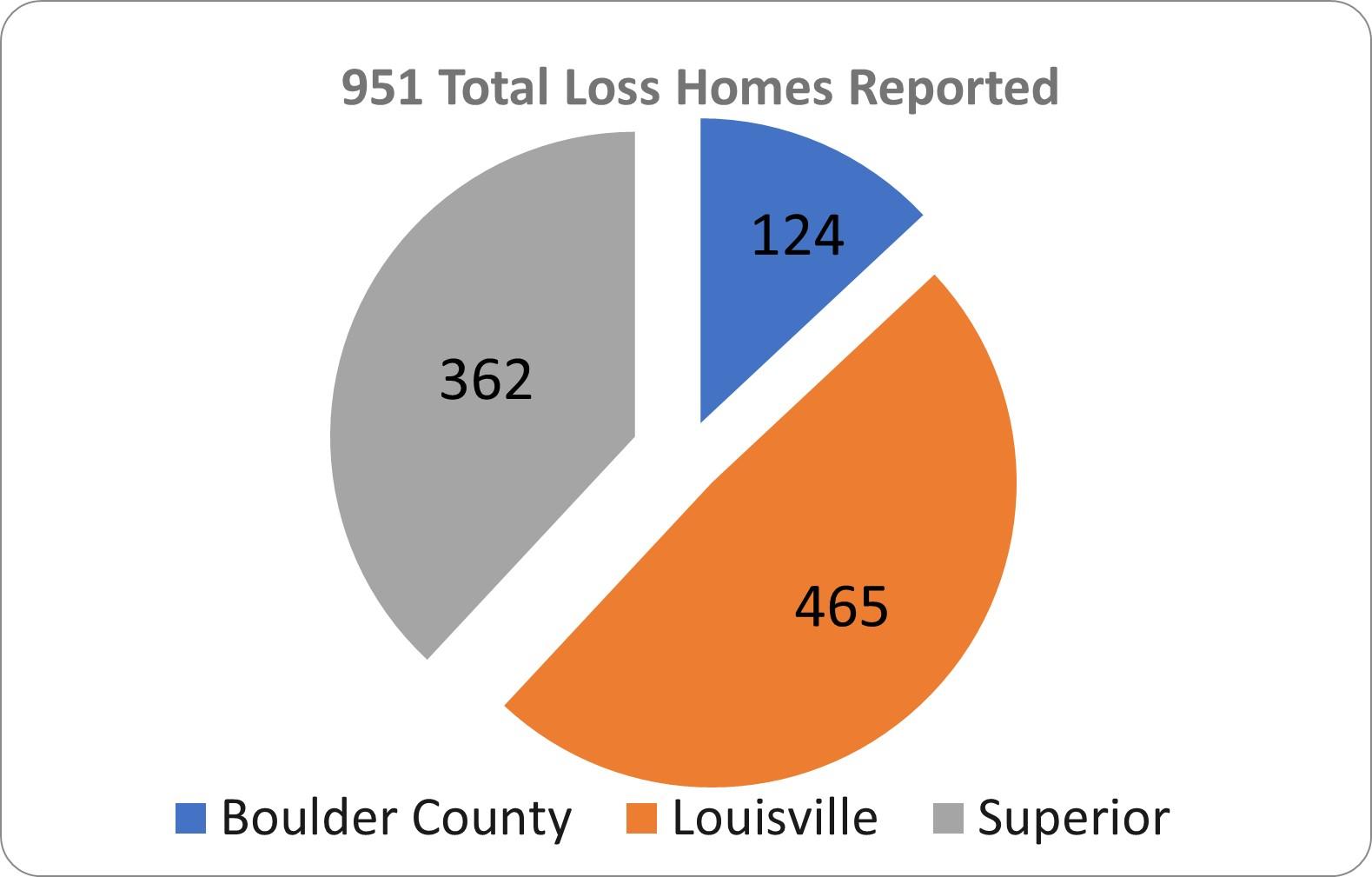

Boulder County identified 1,084 total losses, while the data the DOI collected from insurers captured 983 total loss claims. That difference is likely driven by a number of factors. For example, the Division’s data survey would not capture homes that were rental properties and were covered by commercial policies. Similarly, the DOI did not collect data from what is known as the surplus lines market, where some exceptional or high-dollar homes may have been covered. And while 983 total loss claims were reported, 32 of those claims were either incomplete or did not represent traditional homeowners insurance policies, bringing the number of total loss claims that the Division used for underinsurance analysis to 951 homes (see fig. 1).

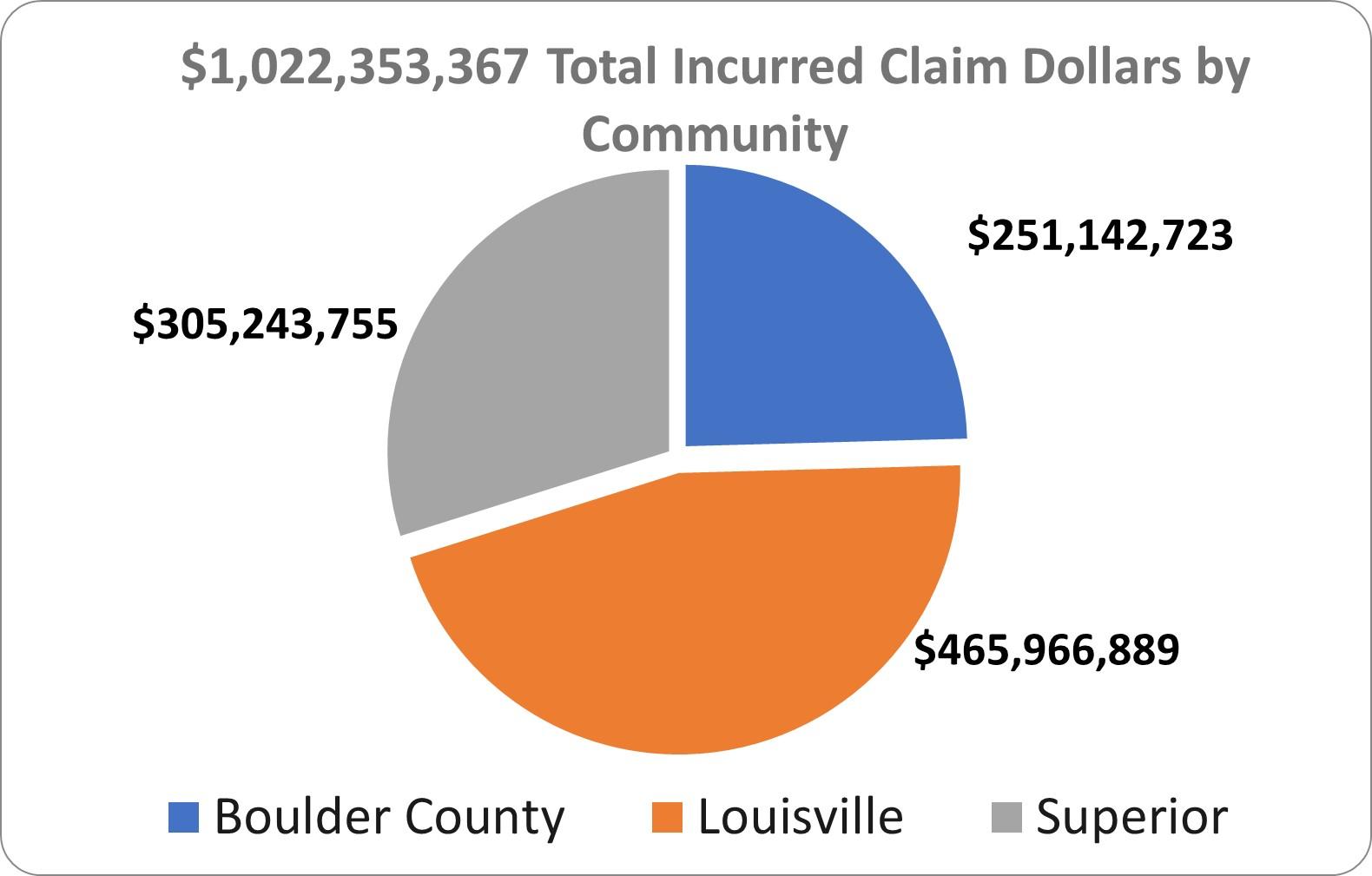

However, the 951 total losses captured in our survey and analysis reflects the vast majority of the homes that were lost to the Marshall Fire, and provides more than enough data to make credible estimates, starting with the $1.02 billion in claims incurred so far for these homes (fig. 2.)

Underinsurance Analysis

This analysis is for Coverage A in homeowners' policies, which is the amount lost and required to rebuild the homes, excluding outbuildings or the personal property they contained.

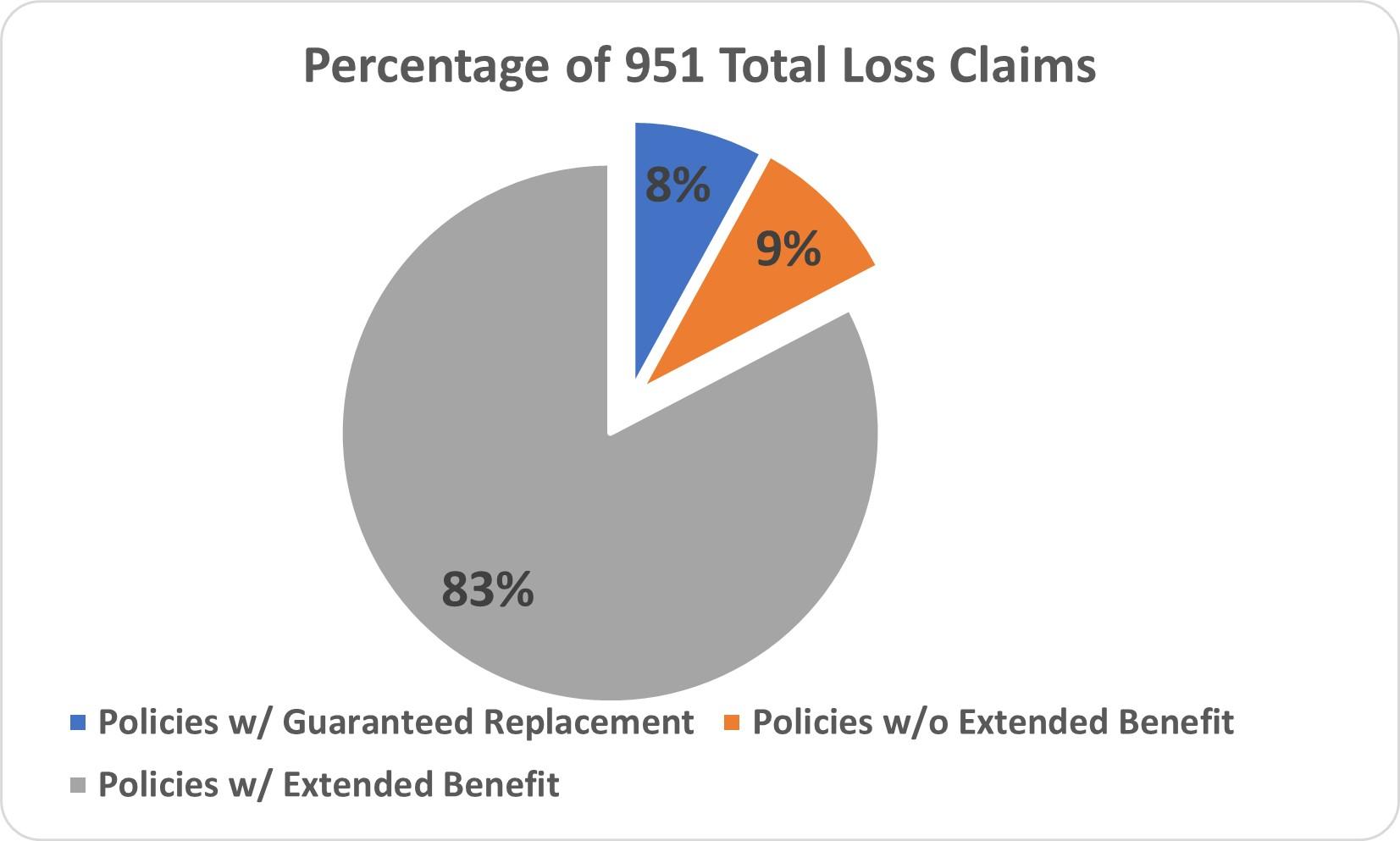

Of the 951 total loss claims analyzed, 76 homes had guaranteed replacement coverage, meaning that the insurance policy on these homes provides coverage for replacement of the home with similar quality, square footage, finishes, etc. without a cap - meaning underinsurance is not a problem for these homes. These 76 homes represent 8% of the homes in the analysis (fig. 3).

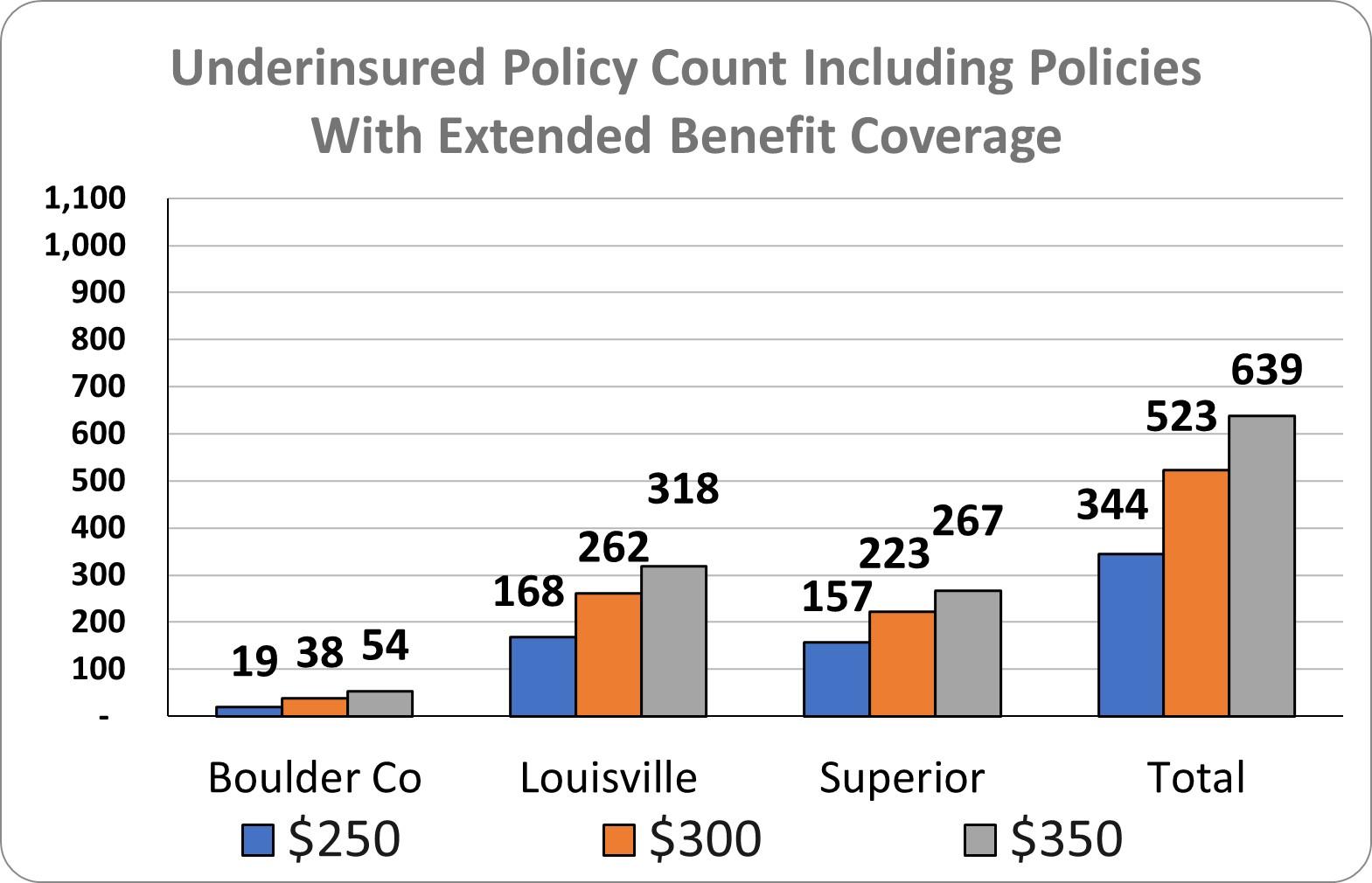

Determining the extent of the underinsurance issue is largely dependent on the anticipated rebuilding costs. The Division analyzed underinsurance using various rebuilding costs - $250, $300 and $350 per square foot. Of the 951 policies, here is the breakdown for how many are underinsured (fig. 4). Note that these policies that are underinsured include both policies that have extended benefits coverage, meaning coverage that provides some additional coverage if rebuilding costs exceed policy limits (83% of policies), and policies without such extended coverage (9% of policies).

- At a rebuild cost of $250 per square foot, a total of 344 (36%) policies are underinsured.

- At $300 per square foot, 523 (55%) policies are underinsured.

- At $350 per square foot, 639 (67%) are underinsured.

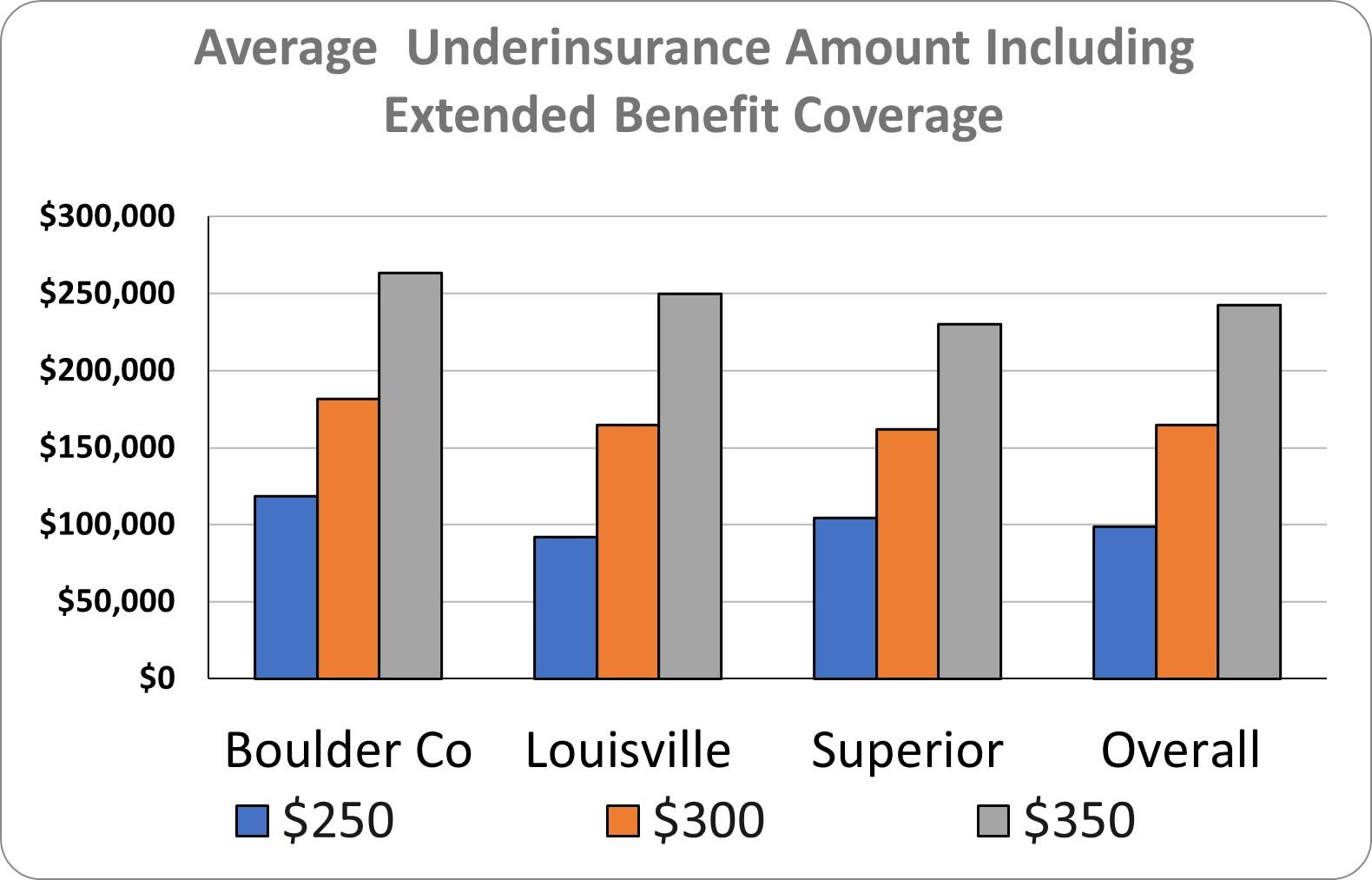

The DOI also calculated the average amount of underinsurance per policy, using the same rebuilding costs of $250, $300 and $350 per square foot (fig. 5).

- At $250 per square foot, for the 344 policies, the average amount of underinsurance per policy is estimated at $98,967.

- At $300 per square foot, for the 523 policies, the average amount of underinsurance per policy is estimated at $164,855.

- At $350 per square foot, for the 639 policies, the average amount of underinsurance per policy is estimated at $242,670

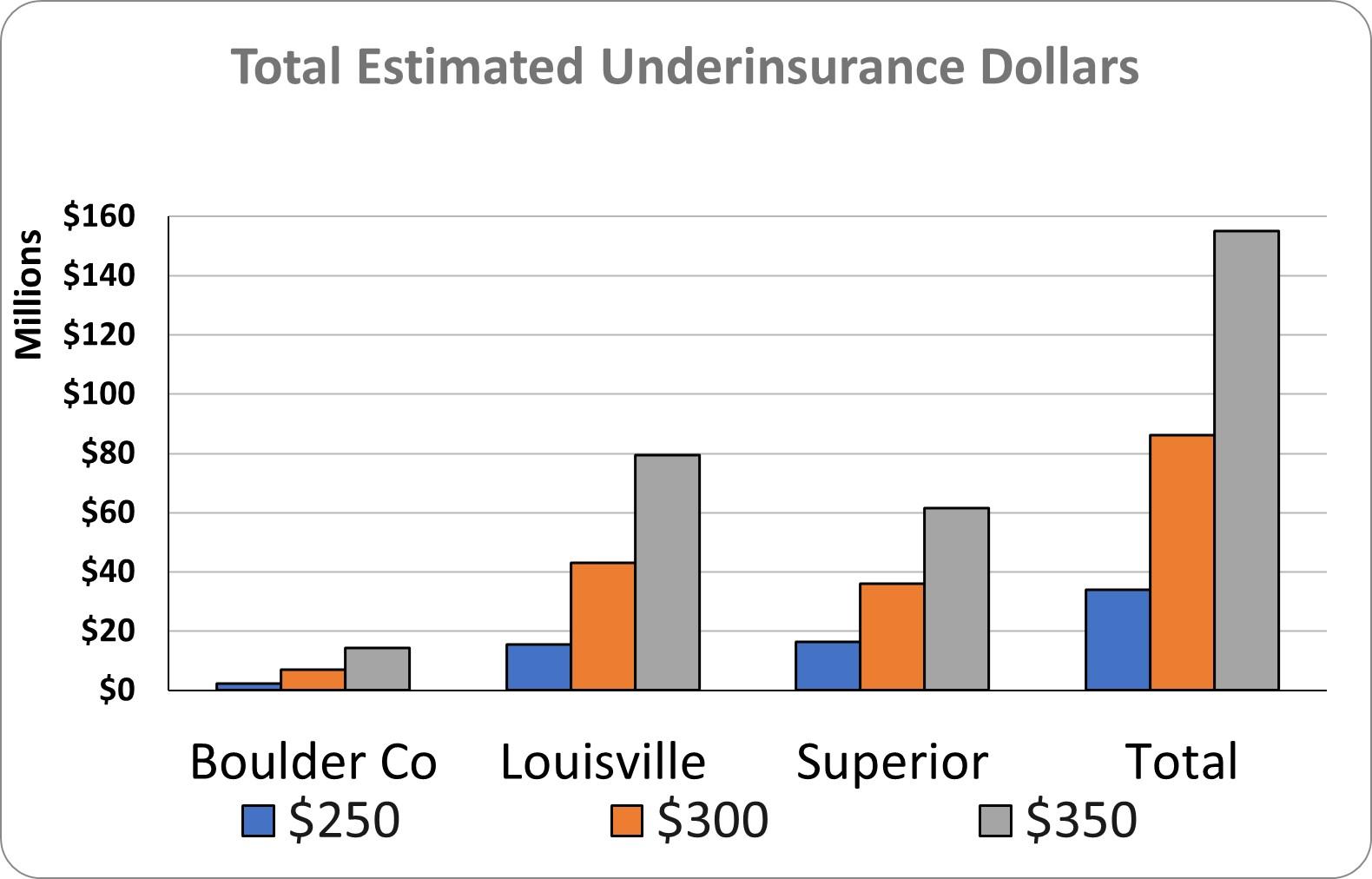

The total amount of underinsurance also varies by the estimated rebuilding costs (fig. 6).

- At $250 per square foot, the estimated total amount of underinsurance is $34 million for the 951 homes captured in our data.

- At $300 per square foot, the estimated total amount of underinsurance is $86 million for the 951 homes captured in our data.

- At $350 per square foot, the estimated total amount of underinsurance is $155 million for the 951 homes captured in our data.

As stated above, the Division conducted this analysis on 951 total loss claims. Boulder County has reported that there were 1,084 total losses from the Marshall Fire. Applying the same basic assumptions for calculating the total amount of underinsurance for the number of total losses reported by Boulder County results in the following estimates.

- At $250 per square foot, the estimated total amount of underinsurance is $39 million dollars for 1,084 total losses.

- At $300 per square foot, the estimated total amount of underinsurance is $100 million for 1,084 total losses.

- At $350 per square foot, the estimated total amount of underinsurance is $179 million for 1,084 total losses.

As of the end of March, the U.S. Small Business Administration has approved $91.2 million for homeowners impacted by the Marshall Fire. Much of that will likely be used towards closing the gap between insurance and the costs of rebuilding.

Next Division of Insurance Town Hall

The DOI will hold a town hall the week of May 16th to discuss this data and any other next steps that have been identified for assistance. As soon as a date and time are decided, information about the town hall will be posted on the Division’s Marshall Fire Response website, and information will be sent to the Division’s Marshall Fire email list (sign up for Division of Insurance email lists here).

If you have any questions or complaints about your insurance, contact the Division of Insurance. Our Consumer Services Team is a dedicated unit for helping Coloradans work with and understand their insurance - 303-894-7490 / DORA_Insurance@state.co.us / doi.colorado.gov (click on “File a Complaint”).

###

About the Division of Insurance:

The Colorado Division of Insurance (DOI), part of the Department of Regulatory Agencies (DORA), regulates the insurance industry and assists consumers and other stakeholders with insurance issues. Visit doi.colorado.gov for more information or call 303-894-7499 / toll free 800-930-3745.

About DORA:

DORA is dedicated to preserving the integrity of the marketplace and is committed to promoting a fair and competitive business environment in Colorado. Consumer protection is our mission. Visit dora.colorado.gov for more information or call 303-894-7855 / toll free 800-886-7675.