Media Contacts:

DOI - Vincent Plymell

vincent.plymell@state.co.us

Governor's Office - Conor Cahill

conor.cahill@state.co.us

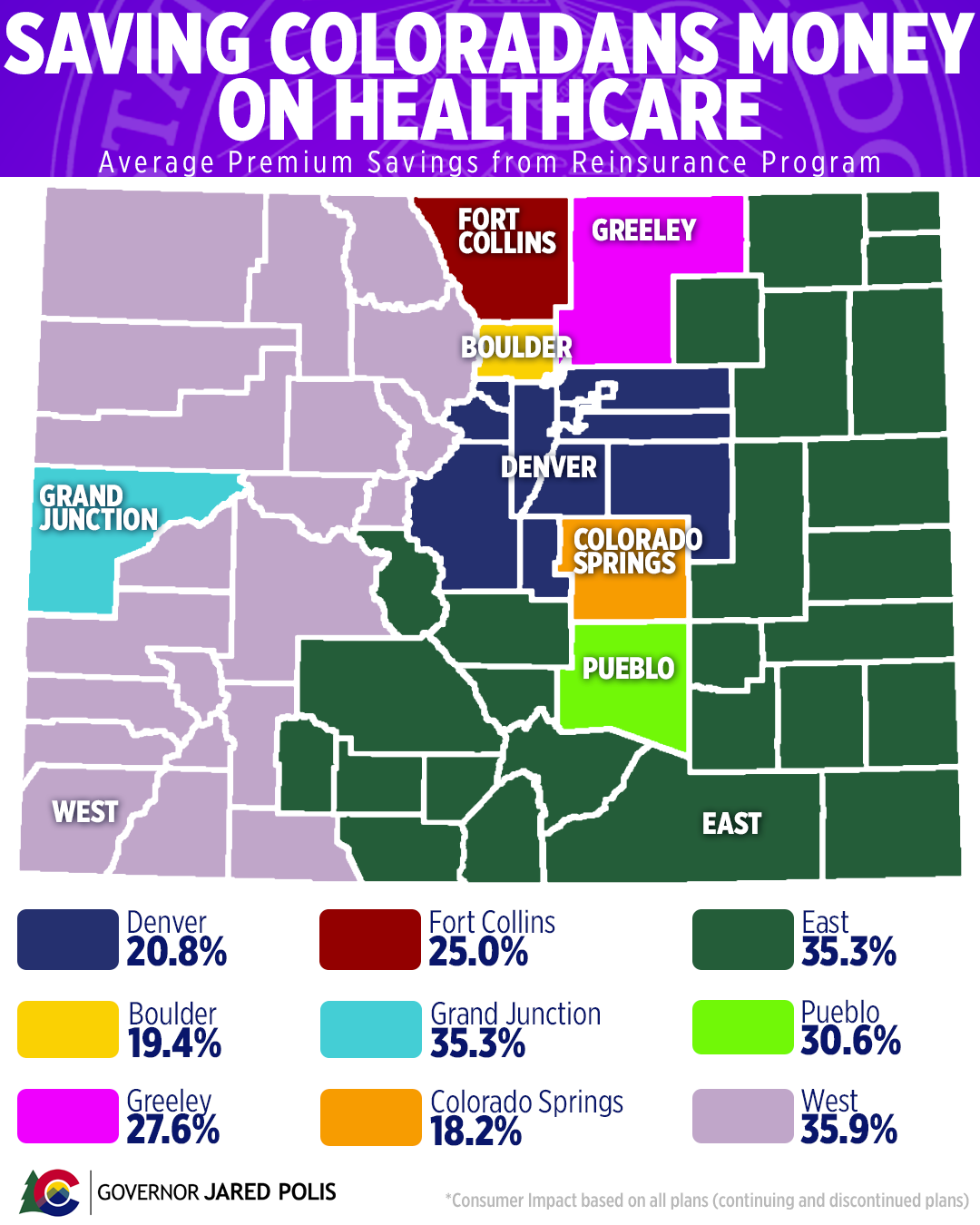

Preliminary Information Shows Even Greater Savings in 2022: 24.1% Savings from Bipartisan Reinsurance Program

DENVER - Governor Polis and the Colorado Division of Insurance (DOI), part of the Department of Regulatory Agencies (DORA), released preliminary information about the health insurance plans and premiums for 2022, for the individual market (meaning health insurance plans for people who don’t get their insurance from an employer) and the small group market (for small businesses with 2-100 employees).

“We need to do more, but our effort to save people money on healthcare is working. Saving people money on health care continues to be a top priority for our administration especially as we build back stronger and the bipartisan reinsurance program is delivering real results. Keeping premiums down an average of 24.1% in the individual market through the reinsurance program means hardworking families will have more money for things like after-school activities, a summer vacation or help with housing,” said Governor Jared Polis.

The savings from the reinsurance program have increased this year. The Colorado Option which Governor Polis signed this year and its standard benefit plan will give Coloradans another tool to save money on health care starting in 2023.

In addition, insurance companies continue to expand where they are offering plans across the state, in both the individual and small group markets. In the individual market, the companies’ proposed expansions for 2022 will leave only one county with a single on-exchange insurance company available - down from 10 counties in 2021, and 22 counties in 2020.

“Reinsurance continues to deliver health care savings for Coloradans. It is keeping health insurance more affordable, which means more Coloradans with insurance, getting access to the health care they need and deserve. And when the Colorado Option comes online for 2023, we can expect to see savings on health insurance continue for folks,” said Colorado Insurance Commissioner Michael Conway. “The companies’ expansion into more counties all across Colorado highlights the strong, robust health insurance market we have and demonstrates that we are doing the right things to give Coloradans options.”

The filings are now available for public comment until Aug. 20, 2021.

Individual Plans

The reinsurance program continues for 2022 for individual health insurance plans, and the DOI has calculated that for 2022, the program will save Coloradans an average of 24.1% over what the premiums would have been without reinsurance. This will be the third year of the program established by the 2019 legislation, HB19-1168, and approved by the federal government in 2019, and extended an additional five years with legislation in 2020 (SB20-215). For more information about the reinsurance program, visit the DOI’s “Reinsurance Program” website.

Based on what the insurance companies have submitted to the DOI for 2022, the overall average consumer impact on premiums in the individual market will be a 1.4% increase over the 2021 premiums. These are the health insurance plans available to individuals on Connect for Health Colorado, the state’s health exchange made possible by the ACA.

Keep in mind that the information on the plans and requested premium changes is only what the insurance companies have requested for 2022, not what has been approved. Throughout the summer and into early fall, the Division will review all the information the companies filed to ensure that changes in premiums are justified and that the plans comply with state and federal regulations. The final, approved plans and premiums will be made available in mid-October.

- 2022 Preliminary Impact of Reinsurance Program on Individual Premiums

- 2022 Individual and Small Group Preliminary Submitted Premium Changes by Insurance Company

Companies Expand Offerings in Colorado

In the individual market, Colorado will again see the same eight companies from 2021 returning to offer plans for 2022 - Anthem, Bright Health, Cigna Health, Denver Health, Friday Health, Kaiser, Rocky Mountain Health Plans and Oscar Health. But many of the companies are expanding their footprints. In the individual market, Bright Health, Friday Health, Oscar Health and Rocky Mountain HMO are all adding more counties where they will sell plans.

For 2022, based on the preliminary information from the companies, there will only be one county, Jackson, with a single on-exchange insurance company selling plans. In addition, in the Denver Metro area, Oscar has added UC Health and its hospitals to its provider network. Throughout 2021, none of the companies offering individual plans had a contract with UC Health.

In the small group market, Bright Health, Friday Health and United Healthcare of Colorado are adding counties. United Healthcare is picking up the counties formerly served by its subsidiary, Rocky Mountain HMO, as it will stop selling small group plans for 2022.

A total of 16 insurance companies plan to offer 526 individual and 550 small group plans in Colorado, both figures a significant increase over 2021 (326 individual and 429 small group plans).

Small Group Plans

In the Small Group Market (for employers with 2-100 employees), the overall average change in premiums propose an increase 5.3% over the 2021 premiums. Again, this information is also preliminary, based on what the companies submitted to the DOI. Saving money in the Small Group Market is why the Polis administration insisted on including the small group market in the Colorado Option reforms, which are expected to begin reducing the Small Group Market rate by 2023.

View Plans / Submit Comments

The plans and requested premiums from the insurance companies, also called filings, are accessible from the Division’s “Insurance Plan Filings & Approved Plans” website. Note that these are very technical documents, so be prepared to spend some time on this process. There is a step-by-step video guide (also available as a downloadable print guide) to help you navigate to the filings that interest you, to demonstrate how to find particular information in those filings, and to show you how you can submit comments. The tables with preliminary information linked above are also available on this site.

Comments must be received by Aug. 20, to be addressed and incorporated into the DOI’s review of the companies’ filings.

###

About the Division of Insurance:

The Colorado Division of Insurance (DOI), part of the Department of Regulatory Agencies (DORA), regulates the insurance industry and assists consumers and other stakeholders with insurance issues. Visit doi.colorado.gov for more information or call 303-894-7499 / toll free 800-930-3745.

About DORA:

DORA is dedicated to preserving the integrity of the marketplace and is committed to promoting a fair and competitive business environment in Colorado. Consumer protection is our mission. Visit dora.colorado.gov for more information or call 303-894-7855 / toll free 800-886-7675.