OmniSalud

OmniSalud

Health Insurance Tip

It's time to schedule your annual doctor's appointment! Remember, 'OmniSalud' is NOT the name of your plan—call your insurance company to find an in-network doctor.

Check out our video "How to Use Your Insurance Card' below to learn more!

What is OmniSalud?

Watch this video to learn about OmniSalud, how to see if you qualify for financial assistance, when to enroll, and more! Keep exploring our page for more educational videos on how to use your health insurance plan that you received through OmniSalud.

If you have any questions please email OmniSalud@state.co.us

.

If you signed up for a plan through OmniSalud watch this video to learn how to use your benefits, find a doctor, understand your coverage, and more!

Learn about insurance terms and how to use your coverage to pay for medical care. Watch this video to understand key concepts like deductibles, coinsurance, out-of-pocket maximums, and more—plus how to use them to your advantage when managing medical costs

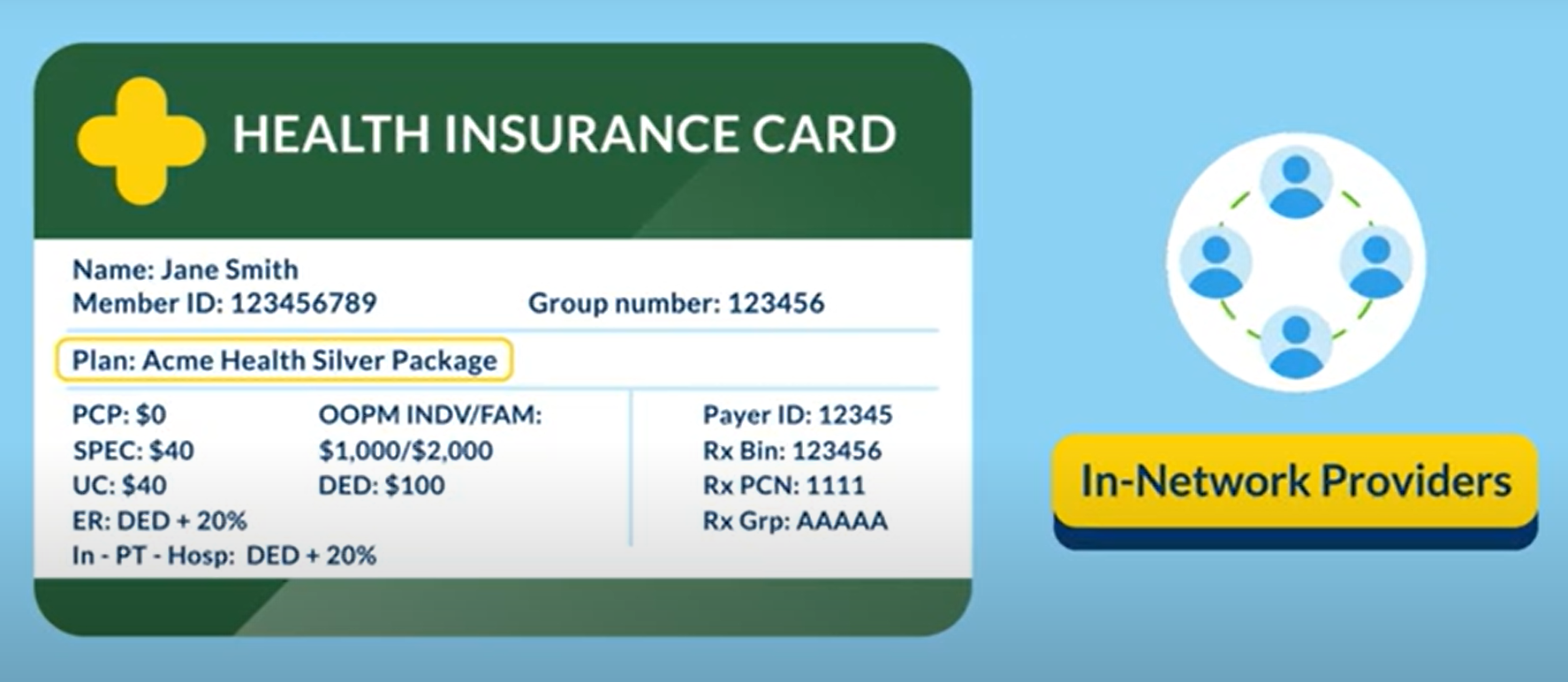

Want to get the most out of your health insurance? Learning to read your insurance card is the first step! Plus, finding a primary care provider (PCP) in your network can save you money and hassle. Watch this video for a quick, easy breakdown of what’s on your card and how to use it.

Whether you have a visa, a work permit, or are undocumented, there is a health insurance option for you. Watch the video below to learn what you qualify for based on your immigration status.

Who can apply for OmniSalud?

People who do not qualify for any other state program, such as Medicaid and financial assistance through Connect for Health Colorado. Undocumented Coloradans and DACA recipients fall into this category.

Where is OmniSalud available?

OmniSalud is only available in Colorado.

What is SilverEnhanced Savings?

SilverEnhaced Savings is the financial assistance offered to folks on OmniSalud who qualify based on their household size and monthly or annual income.

When can I sign up for insurance?

People who are currently enrolled in OmniSalud will have their spot saved starting November 1st, 2024th through November 22nd, 2024 as long as they continue to to meet the requirements for OmniSalud.

ACTION NEEDED: Current enrollees must sign up with the same email address they signed up for in 2024. To find an assister or a broker to help you re-enroll please visit https://connectforhealthco.com/get-started/omnisalud-help/

Where can I sign up?

Find an expert near you by visiting https://connectforhealthco.com/get-started/omnisalud-help/ or by calling Colorado Connect's service center at 855-675-2626

What information do I need to provide to sign up for the program?

When you apply, you will need your name, address, and a clear idea about your monthly or annual income. You won't be asked to provide verification of income.

Will I become a public charge if I enroll in a plan through the OmniSalud program?

No. When applying for this program, you will not be asked for your immigration status. Additionally, the Department of Homeland Security (DHS) does not consider this type of health insurance coverage and assistance when making public charge determinations.

What insurance companies offer OmniSalud?

Anthem Blue Cross Blue Shield, Cigna, Denver Health, Rocky Mountain Health Plans, Select Health, and Kaiser Permanente.

If you want to submit an event to this calendar please fill out this form