ACA Annual Filing Information

Welcome to Plan Year 2027

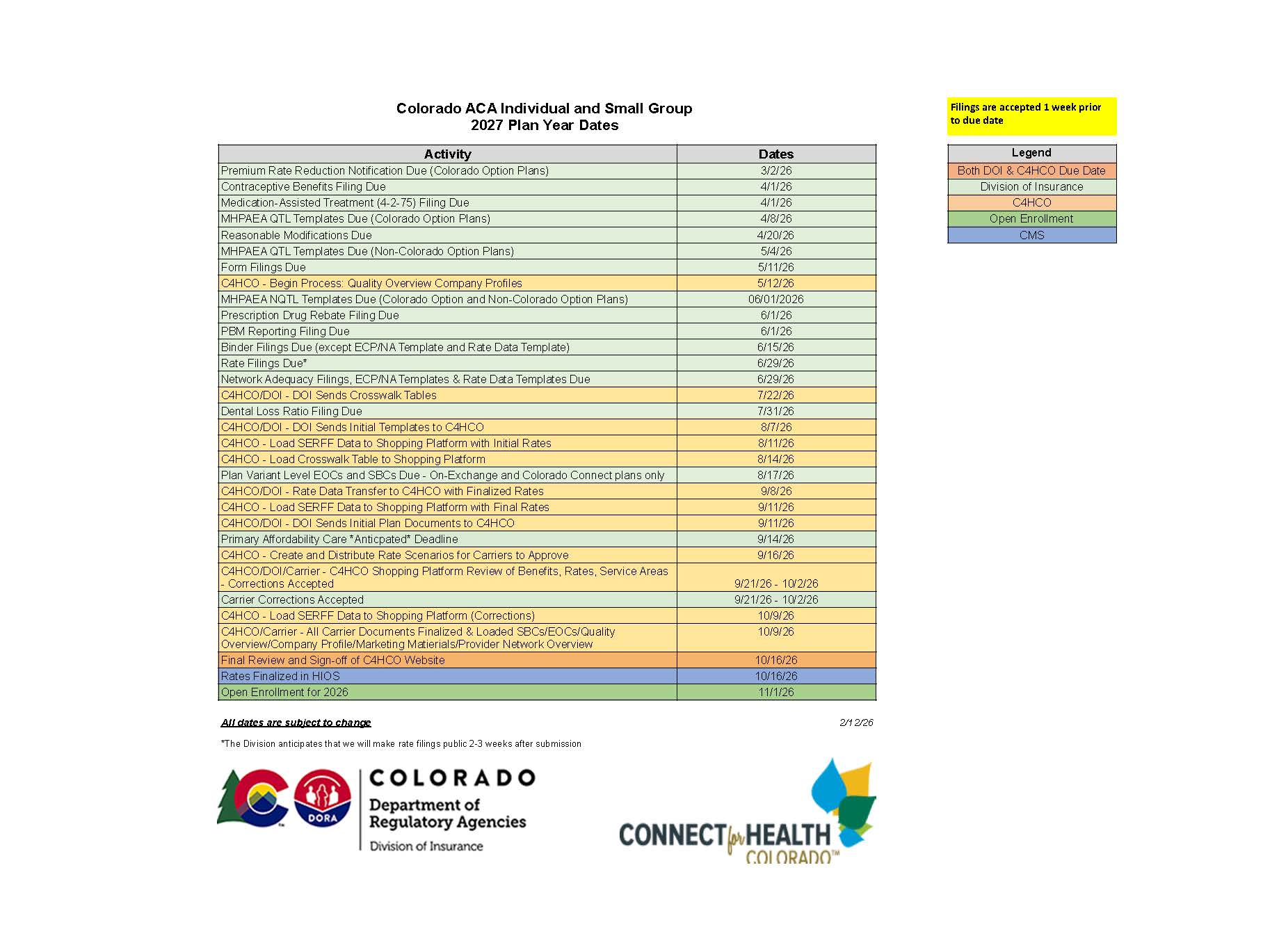

The Plan Year has kicked off as of February 12th, 2026 with the issuance of the PY27 External Timeline. All dates subject to change.

Behavioral Health Annual Filings

Mental Health Parity and Addiction Equity Act (MHPAEA) Technical Training - to assist insurance companies in completing the templates for required MHPAEA filing

Premium Rate Reduction (CO Option)

- Plan Year 2027

- Premium Rate Reduction Filing Instructions (Updated 2/5/26)

- Premium Rate Reduction Filing Materials

- BY2027 Colorado Option Negotiated Rate Template

- BY2027 Material Provider Premium Impact Template

- BY2027 Maximum Allowable Reduction Template (revised)

- BY2027 Joint Attestation Template (Fillable)

- BY2027 Joint Attestation Template (Pediatric Hospitals) (Fillable)

- March 1 Colorado Option Network Adequacy Attestation Form

- 2027 Colorado Option Hospital-Specific Reimbursement Floors

- Premium Rate Reduction Notification Templates- Individual Market

- Premium Rate Reduction Notification Templates- Small Group Market

- BY2027 Final Summary Template

Forms

- PY2026 Form Filing Instructions

- PY2026 Specific Coverages and or Exclusions List

- Uniform Applications

- English

- Spanish (Aplicaciones uniformes)

- Anexo de empleados de Connect for Health Colorado EN-003-02

- Anexo individual de Connect for Health Colorado EN-002-02

- Solicitud Uniforme de Empleados de Colorado Para Planes de Beneficios de Salud Para Grupos Pequeñs- Appendix A

- Solicitud Uniforme de Personas de Colorado Para Planes de Beneficios de Salud Principales (1.1MB)- Appendix B

Binder Filing Instructions - Current Plan Year

SBC Filing Instructions - Current Plan Year

Templates

- 4-2-58 Formulary Compliance Template

- Pharmacy Benefit Managers

- Prescription Drug Formulary Attestation Form

- Colorado Issuer ECP Attestation Template - Fillable

- Colorado Silver Plan Crosswalk Template

- Colorado HIOS Plan ID Crosswalk Template

- Reinsurance Program Care Management Protocol Assessment

- URLs - Medical and Dental

- CO PBT Add-In

- Confidentiality Index

Rate Filing Instructions

Templates

- Regulation 4-2-39 Rate Template

- ACA Supplemental Template

- Prescription Drug Estimated Rebate Attestation

- Premium Impact Analysis Template

- Wakely - DORA Standard Plans AV Certification

- Confidentiality Index

CO DOI - SADP AV Supporting Documentation

Current Plan Year - Stand Alone Dental Plan Filing Instructions

Confidentiality Index

Gender Dysphoria Annual Filing

MAT Reporting (Regulation 4-2-75) - UPDATED 2.20.26

- Instructions

- Templates

- Regulation

Annual MHPAEA Filings (Quantitative Treatment Limitations and Nonquantitative Treatment Limitations)